To have both partners in a marriage actively budget their expenses together is rare.

Instead, one spouse is usually the one who handles the budget and the finances. If the budgeter is lucky, his or her spouse will sit down once a month and listen and discuss the current state of finances.

If the budgeter isn’t so lucky, the spouse will not even sit down to listen to the budget but instead leave the finances completely in the budgeter’s hands.

In Kate and Charlie’s marriage, Charlie completely handled the finances. When Charlie had a stroke and was hospitalized and in rehab for three months, Kate had no idea what bills needed to be paid or even how to get into their accounts electronically.

Unfortunately, this scenario is all too common.

If you’re the budgeter, you should take these steps so if anything happens to you and you become incapacitated or pass away, your spouse will be able to figure out when to pay bills and how to log into electronic accounts.

Quick Navigation

Make Note Of When Bills Are Due

The first step is to find a way to let your partner know when bills are due. I’m the budgeter in our family, and I use You Need a Budget (YNAB). For each bill’s line, I’ve included the amount due and the date the bill is due.

If you don’t use an electronic budget system, you can simply make a generic calendar and list the name of each bill on the day it’s due and the amount you must pay.

Create A List Of Debts

Next, create a list of debts for your spouse. You should include the following:

- Name of the company

- Credit limit

- Current balance

- Minimum monthly payment

- How to pay the bill

- List of websites & passwords (more below)

Create A List Of Websites And Passwords

Perhaps the most important piece of information is the list of websites and passwords.

Find a safe place to list all of the websites for the accounts that you have.

We would recommend a secure password software like LastPass where you can give your loved one a single login, and then they'll have access to all of your important financial website logins and passwords. You can even categorize all of your logins within the software by category (financial/social media/work).

Once whatever software you choose is setup, just give the login name and password to your spouse. If you have a security question, give the answer to that, too. If you have a picture you must choose before logging in, write down what that is.

Just make all of the information available so your spouse can login even if you can’t convey information to him or her because you’re incapacitated or have passed away.

Setup Emergency Access

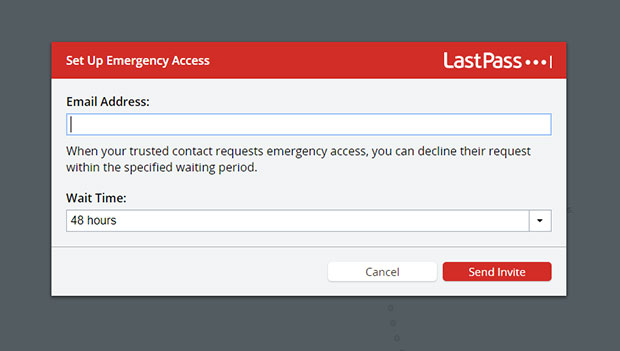

If you prefer to not give your spouse your login right now, software like LastPass also have the tools in place to give a trusted contact(s) emergency access to your account.

You just enter your trusted contacts in the emergency contacts section, then if they request access if something happens, if you don't respond within 48 hours they'll be given emergency access.

Show Your Spouse Important Information

Next, show your spouse exactly where you’re keeping all of this important information so that he or she can find them if they’re needed.

For your part, make sure you keep the documents in the same spot you told your partner so he or she can find them.

Keep Your Lists Current

While it’s great to set up this system, if you set it up and then don’t touch it for five years, your partner may still be lost should he or she have to take over.

Every time you change a password, make the change on your master sheet (LastPass makes this easy).

Every six months or so, review the information and make sure that it’s still valid. Over time, you’ll close some accounts and open others, and some bills, like mortgages, may be taken over by other mortgage companies.

Make sure your list stays current.

While you may be frustrated that your spouse doesn’t participate in the budgeting process, realize that there are likely things he or she does around the home that you have no interest in doing.

Then, take the time to create a system where your spouse can take over for you with minimum disruption, should the need arise.

Are you the budgeter in the family? If so, what steps are you taking to make sure your spouse can take over if need be?

Share Your Thoughts: