Millions of Americans received an automatic deposit into their bank account as part of the CARES Act last month.

This infusion of cash gave them the ability to pay bills, buy groceries, or simply save money. However, some Americans were left waiting, and waiting, for their money.

Finally, just recently some began to receive checks or debit cards. But debit cards frustrated some people who didn’t want to run out and spend the money right away.

Luckily, those who received debit cards do have other options.

Quick Navigation

Do I Have To Spend The Money On The Stimulus Debit Card?

The short answer to that question is no.

Even though on the surface it looks like a stimulus debit card doesn’t offer as much flexibility, there are ways to get around this.

Withdraw The Money

The easiest solution is to simply go to the bank and ask for the money on the debit card to be withdrawn and put into your savings or checking account. There is no fee to do this.

Use The ATM

Another option is to use the ATM to withdraw the money. There’s no fee for this, either. However, the card does have a $1,000 per transaction limit on the amount you can withdraw. If you’re a couple or a family with kids and received a larger economic impact stimulus payment, you’ll likely have to have several ATM transactions to get all of your money.

Utilize PayPal

Another option is to upload the debit card to PayPal and then transfer the money from PayPal to your bank account.

This is an easy way to obtain the cash while limiting public interactions, especially if you are in the high risk category for the virus and continuing to stay home for the most part.

Use The Debit Card For A Designated Category In Your Budget

If you don’t have easy access to a bank or PayPal, you can use the money in a different way. Let’s say you set aside $800 a month for groceries. Rather than using your cash for groceries, use the stimulus debit card.

Take the $800 in cash that you would have used for groceries if you hadn’t had the debit card and put it in your savings if your preference is to save the stimulus money.

You can use this same strategy for any category in your budget where you can use the debit card instead. You may need a few months to get all of the cash from the card this way, but you will be able to save the stimulus money.

Don’t Mistake The Stimulus Debit Card For Junk Mail

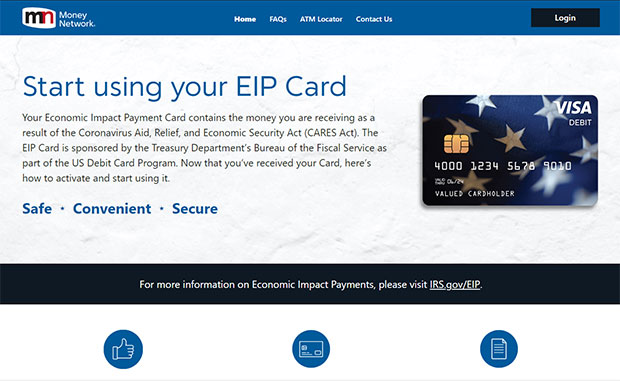

Many Americans have mistaken the envelope and letter with the stimulus debit card as junk mail and thrown it away! Don’t make that mistake.

Be on the lookout for a white envelope labeled, “Money Network Cardholder Services.”

If you do lose the card, there is a small fee (less than $20) to replace it.

Who Will Be Getting The Debit Card

In general, individuals who didn’t provide bank account information on their tax returns will get a check or debit card.

The debit cards will be issued to individuals from Maine, Maryland, Massachusetts, New Hampshire, Vermont, Florida, Louisiana, Mississippi, Oklahoma, and Texas.

You Don't Have To Spend The Debit Card Money, But Make Sure To Withdraw

If you’ve received a debit card from the government and are wondering, “Do I have to spend the money on the stimulus debit card?”, the answer is no.

However, I would recommend taking the money off the card if you have bank access because there are always desperate scammers who are eager to get their hands on the cash on the debit card.

Share Your Thoughts: