Yesterday we talked about one of the negative effects of the recent tax cut package that was passed, the fact that taxpayers who itemize must delay filing. If you're expecting a big refund and anticipate claiming quite a few deductions, you'll most likely need to wait to file taxes until mid to late February.

Today I want to touch on another tax credit that was extended that a lot of parents will be happy about, the $1000 child tax credit.

An Extension Of The $1000 Child Tax Credit

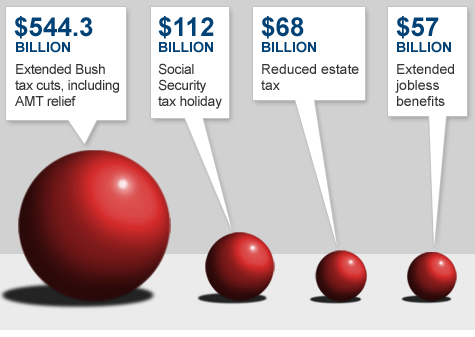

Congress and President Obama took action on the expiring Bush era tax cuts on December 17th last month. The passage of the bill lead to a lot of relieved sighs for many folks as a lot of popular tax breaks were set to expire, and the bill extended many of them, even if just temporarily. There was a smaller version of the home improvement tax credit, an extension of the current tax rates (instead of a huge tax hike), and a payroll tax holiday, meaning a cut of 2% in Social Security tax withholdings in 2011.

In addition to the measures mentioned above, under H.R.4853 the Child Tax Credit (CTC) of $1000 per child will be extended for 2011-2012 as well.

I've got a co-worker and friend who just had his 5th child this past year. In most instances having that many children leads to a ton of expenses, but this is one case where he comes out ahead. I think he was pretty happy that the $1000 child tax credit was passed as it will mean $5000 in tax credits for him – $2500 more than if it had expired and returned to the previous $500 per child level.

We'll be claiming the child tax credit for the first time this year as well as we just had our first child. Daddy thanks you, my little one!

Since this is a tax credit, it means that once you figure out how much you owe in taxes for the year, the amount of credit will reduce the amount of tax owed (as opposed to a deduction which reduces taxable income). For example, if we owed $3000, and claimed the child tax credit for our one child, we would then owe $2000.

Who Is Eligible For The Child Tax Credit?

The Child Tax Credit has eligibility requirements, and is subject to income limits and phaseouts.

- Income limit of $75,000 for single parents.

- Income limit of $110,000 for married couples.

- Income limit of $55,000 for married filing separately.

After these income levels the credit is reduced by 5% of adjusted gross income.

Quick Facts From The IRS: The Child Tax Credit

The IRS recently put some guidance on their website about who is able to claim the Child Tax Credit. If you've already claimed the credit you probably already know these things, but I thought I’d share them here as a reminder.

1. Amount – With the Child Tax Credit, you may be able to reduce your federal income tax by up to $1,000 for each qualifying child under the age of 17.

2. Qualification – A qualifying child for this credit is someone who meets the qualifying criteria of six tests: age, relationship, support, dependent, citizenship, and residence.

3. Age Test – To qualify, a child must have been under age 17 – age 16 or younger – at the end of 2010.

4. Relationship Test – To claim a child for purposes of the Child Tax Credit, they must either be your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister or a descendant of any of these individuals, which includes your grandchild, niece or nephew. An adopted child is always treated as your own child. An adopted child includes a child lawfully placed with you for legal adoption.

5. Support Test – In order to claim a child for this credit, the child must not have provided more than half of their own support.

6. Dependent Test – You must claim the child as a dependent on your federal tax return.

7. Citizenship Test – To meet the citizenship test, the child must be a U.S. citizen, U.S. national, or U.S. resident alien.

8. Residence Test – The child must have lived with you for more than half of 2009. There are some exceptions to the residence test, which can be found in IRS Publication 972, Child Tax Credit.

9. Limitations – The credit is limited if your modified adjusted gross income is above a certain amount. The amount at which this phase-out begins varies depending on your filing status. For married taxpayers filing a joint return, the phase-out begins at $110,000. For married taxpayers filing a separate return, it begins at $55,000. For all other taxpayers, the phase-out begins at $75,000. In addition, the Child Tax Credit is generally limited by the amount of the income tax you owe as well as any alternative minimum tax you owe.

10. Additional Child tax Credit – If the amount of your Child Tax Credit is greater than the amount of income tax you owe, you may be able to claim the Additional Child Tax Credit.

Child Tax Credit Resources

- IRS Publication 972: Child Tax Credit (PDF)

Are you claiming the child tax credit this year? How much will you save because the credit is extended at the current $1000 level?