At some point, you might end up in a situation where you feel like you need to withdraw money from your retirement account. You might have come up against some unexpected hardship, and need the money, or you might want the money for an education, or to help with the down payment on a home.

If you have a 401k, you usually have two options when you want to take money out of your retirement account: loan or hardship withdrawal. These are two different options, and it helps to understand the distinctions between the two.

401k Loan

As you probably know, you can borrow from your 401k. If you want to borrow funds, you generally need to provide a statement about what the funds are for. You won't be charged the 10% penalty for being under 59 1/2 (if you are laid off, you won't have the penalty if you are at least 55), and you won't have to pay income taxes on the money. Many employers also offer the option to have you repay the loan over five years, using automatic deductions from your paycheck.

Of course, anytime you borrow money, there are interest charges. The interest is usually low, though, and you are paying it to yourself. Some plans may charge you a processing fee, though, so watch out for that. While a 401k loan can seem tempting, there are some definite downsides. Your employer may not provide a match for your contributions — or even let you contribute at all — until the loan is repaid. Additionally, if you switch employers, you have to repay the rest of the loan within two or three months.

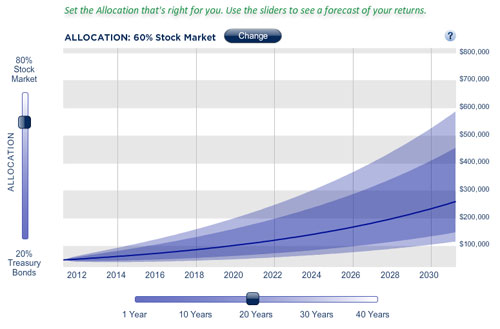

You also can't discount the cost of lost opportunity. Every day that money is not in your retirement account, it's one more day the money isn't working for you. However, sometimes you are just up against a wall. And a 401k loan is better than a hardship withdrawal.

Hardship Withdrawal

You also have the option of a hardship withdrawal. Some of the items that the IRS recognizes as hardships include:

- Tuition

- Medical expenses

- Funeral costs

- Avoiding foreclosure

- Repairing damage to your home

- Purchase of a primary residence

However, a hardship withdrawal is pretty much the same as a regular early distribution. You have to pay your 10% penalty, and the money will be taxed as income. On top of that, there is rule that you have to wait six months to contribute to your 401k after taking a hardship withdrawal.

Withdrawing from Your Roth IRA Instead

If you are going to withdraw from a retirement account, and you have a Roth IRA, you might consider that as a viable option. Because your contributions to a Roth IRA are made with income that has already been taxed, you can withdraw your contributions anytime you want with no penalty. (You will be penalized if you withdraw your earnings early, though, except in certain circumstances.) While it is never ideal to raid your retirement account, if you think there is no other way, you should first see about withdrawing from your Roth IRA. Then, turn to a 401k loan.