This past week I made a mistake, and it was a costly one.

I've been writing personal finance blogs for 3 years now, and in that time I feel like I've learned quite a bit about personal finance. I've learned about the importance of investing early and often, about the power of compound interest, and the importance of staying focused on your goals by using a budget. Just because I write about personal finance, however, doesn't mean that I'm always on top of my own finances unfortunately.

This year has been a stressful one. We had a new baby at our house, and getting enough sleep has been tough. We also have been dealing with various health issues for my wife. In addition it's been busy at my day job – and the blogs I run are all doing well. But again – it's busy.

I Made A Money Mistake

I'm not trying to excuse what happened by explaining it away – and claiming life has just been too stressful and busy to stay on top of things – it's just one of the reasons why I allowed things to get away from me. In reality, it should never have happened.

So what happened to this personal finance blogger? What horrible awful mistake did I make?

I overdrew my checking account. (Gasp! )

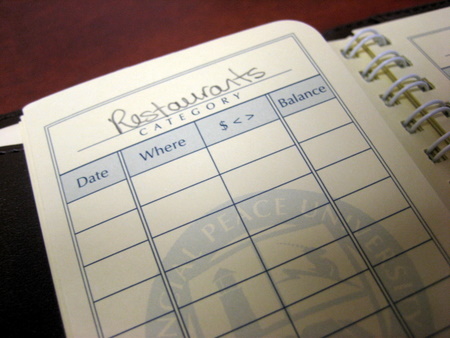

I know it's pretty horrifying. I talk about budgeting all day long every day, yet I can't even keep my own checkbook balanced. So what happened?

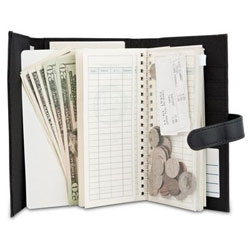

My wife and I currently use Microsoft Money as our budgeting and all around money tool. Sometime last year Microsoft announced that they would be discontinuing the product, and at the end of 2010 the product would no longer allow for online account updates. In other words, the software would stop downloading bank statements and transactions directly into the software.

While that in itself shouldn't have caused me to overdraw my account, what it did was remove one of the checks and balances I had in place. If I forgot about a transaction or didn't get a receipt, it would still show up in my account because all transactions were downloaded from my bank. When the online updates stopped working, my carefully laid plans disintegrated.

Several auto-transfer transactions that previously were automatically entered were now not entered for two months. Also, my wife forgot to enter a pretty large purchase she made online. Because of those oversights the balance we showed in our account was actually about $300 more than we actually had.

At the beginning of this month I paid for several large bills all at once. I paid for our mortgage, my estimated tax bill, as well as a couple of checks to our church. All in all I paid about $2500-3000 in payments all at once. I thought I had more than enough to cover it, but due to the oversights we made, we overdrew our account by $107. The result? $140 in overdraft charges. The worst part was, the day after a payment showed up in my account for $1900. If only I had waited a few days to pay those bills!

Time To Fix Our Problem

When I realized what had happened, I talked to my wife about it, trying to figure out what had gone wrong (already stated above). I hadn't caught the issues because I had been lax in balancing our accounts for the last couple of months. If I had been balancing the checkbook as I normally did, I would have caught these problems a couple of months earlier and avoided this mess. Once we discovered the overdraft I went back and balanced our checkbook based off of my bank statements for the past 3 months. I quickly found the sources of our error.

Ask For The Bank Charges To Be Reversed

So now that I knew what happened, what was I going to do about this big $140 overdraft charge? There's no way I want to pay that – even if I did overdraft. So I decided to ask the bank to remove the charge as this was a one time issue, and it wouldn't be happening again. What's the worse they can do, tell me I have to pay it anyway?

The first customer service rep I talked to told me she could take off one of the charges, so I would still owe $105 in charges. That's better, but still not that great. I asked if I could talk to her manager because I'd like to have all of the charges removed.

She transferred me over, and I told the manager that I'd like the charges removed. The manager told me that she couldn't take them all off, it was “bank policy”. I persisted and said that I would at least like all but one of the charges removed, or I would consider closing my account. At that point she agreed to remove all of them except for one – leaving me a total fee of $35. I may have been able to get that one removed as well, but I can't say I feel as bad about that one fee, because I did make an error. Sometimes you need the pain to remind you not to make the same mistake again.

What I learned from this is that the bank – and the bank manager do have some flexibility to fix a situation for you. You just have to ask.

What I Learned From My Money Mistake

Now that this mistake is behind us, what are some things I've learned from it?

- Everyone makes mistakes: I'm supposed to have it all together – being a personal finance blogger and all. But I'm human, and I make mistakes too. How you learn from your mistakes is the important thing.

- It's important to stay focused on your financial situation, or it can get away from you: If you aren't doing a budget, balancing your checkbooks and keeping spending in check, you will have issues like this too.

- Make sure you have a backup plan: Having this problem also made me realize how important it is to have a backup plan and checks and balances set up. It can help avoid these types of situations.

- Don't let it get you down: When you make a mistake, just brush yourself off, fix the mistake and move on from there. Learn from it, but don't let it haunt you!

Have you made any money mistakes recently? What was it – and what did you learn from it? What do you do to keep things like this from happening?