Yesterday I heard the news that one of my favorite banks, Capital One 360 had just released a new remote deposit app for Iphone and Android devices.

I quickly downloaded the app to take it for a spin. I've got a couple of accounts with Capital One, and knew that I would most likely be using the remote deposit functionality on a regular basis. As a blogger I still get a lot of checks from a wide range of clients, and I need to make deposits more than the average Joe. What better way to deposit them than by quickly snapping a couple of pictures with my smartphone?

Today I thought I'd do a quick look at the Capital One 360 App and it's functionality, and then take a look at what other major banks currently offer some sort of remote deposits.

Capital One 360 Remote Deposit

Capital One 360 had announced that they were going to be releasing a remote deposit feature a while back when they were still with ING, but after they were acquired by Capital One, I'm assuming that the app got pushed to the back burner for a while. Well now it's been released, and it seems to work pretty well.

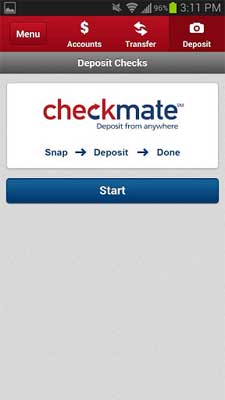

After you login to the app with your account login information, you'll be given the option to view your accounts, transfer money, find an ATM or deposit a check.

After you login to the app with your account login information, you'll be given the option to view your accounts, transfer money, find an ATM or deposit a check.

When you click on the “deposit” link, you'll be taken to the screen below, and prompted to “start”.

The app will advise you that the maximum you can deposit is $3,000 per check, and that you should ensure that you have good lighting when you snap your pictures of the check.

After you take and confirm the pictures of the front and back of the check, you'll be asked to confirm the amount of the check and which account you want it deposited in. When you're done you just hit “deposit” and your check will be deposited. Easy peasy!

You can also take a picture of the front and back of your check with a regular digital camera or scanner, and upload them through your Capital One 360 account on the web if you don't have a smartphone.

The Fine Print With Remote Deposits

There is some fine print when you're doing the remote deposit as far as how long it takes for the money to hit your account, what you can deposit, etc.

- Capital One will only accept U.S. personal, business, and federal checks.

- $3,000 maximum per check.

- Checks deposited into Capital One 360 Checking for less than $500 – first $200 is available the next business day, the remaining funds are available after 2 business days.

- Checks deposited into Capital One 360 Checking for greater than $500 – first $200 is available the next business day, the remaining funds are available after 5 business days.

- Any deposit into a Capital One 360 Savings or Kids Savings Account – funds are available after 5 business days.

Reasons Remotely Deposited Checks Get Rejected

There are times when a remote deposit might get rejected. Some of the reasons that Capital One gives for that include:

- They can’t read your check

- The corners of your check are cut off

- The image is too light or too dark

- Information on the check is unclear

- Check is greater than the $3,000 deposit limit

- You’re missing a signature on the back

What Other Banks Offer Remote Deposits?

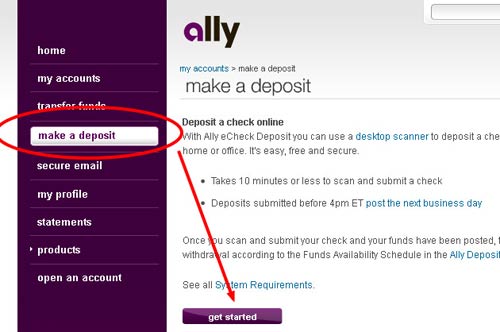

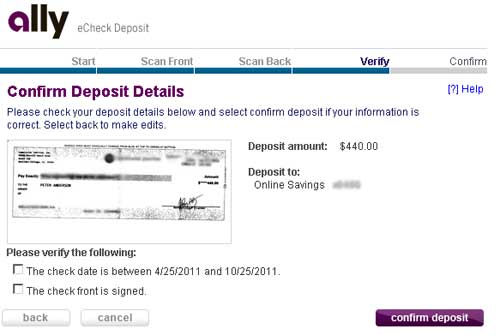

Not all banks currently offer remote deposits, in fact it's still a relatively new feature in the banking sphere. The more popular banks that I know of that currently have remote deposits available in some form include:

- Capital One 360: Capital One just released remote deposits via their app and by scanning in checks via their site.

- Ally Bank: Ally doesn't currently have remote deposit via phone app, but you can scan in and deposit checks through their website. (App is in development)

- Chase Bank: The Chase Mobile app allows you to deposit checks.

- PNC Bank: Their Virtual Wallet app will allow you to deposit checks.

- Charles Schwab: The Schwab Mobile Deposit app allows for remote check deposits.

- USAA Bank: USAA Deposit@Home app allows remote deposits.

What If Your Bank Doesn't Offer Remote Deposit?

If your bank doesn't currently offer remote deposits, there is something else you can do. If you have a PayPal account, you can download the PayPal app which also has a remote deposit feature as well.

Just make sure your bank account is linked to your PayPal account (which it probably already is), scan the check in and then transfer the money to your bank account when it becomes available. Doing it this way will mean a delay of 5-10 days most likely, but if it's your only option, it is a decent option.

Do you currently use remote deposit with your bank account? Have you considered signing up for an account because of this feature? Tell us your thoughts.