Having a bank account is absolutely necessary these days.

People rely on banks for many services. They use them to make sure all of their bills are paid, as well as having easy access to any money they've worked hard to earn.

Many people develop a relationship with their bank. They rely on the bank not only as a place to store funds, but also as a place where they can seek out financial advice.

A bank can help with other aspects of their lives, including financing a home and planning for retirement. A good bank can help them make important life decisions such as what kind of investing is right for their risk tolerance level and how to afford the house in the neighborhood they like best.

While a great relationship with a bank is ideal, sometimes this relationship isn't quite working out. In that case, it may be time to think about switching to another bank.

What To Look For in a New Bank

The process of looking for a new bank may feel quite confusing. Many people have an idea of the kind of bank they want to find but aren't always sure what will work.

It's a good idea to take the time to look carefully. Banks like https://www.oakstarbank.com/ can help.

It's a good idea to think about the person's overall finances. People are at different stages financially in life. A young person just starting out may have concerns such as paying off student loans. An older couple may be looking ways to help them increase their savings and pay for retirement as well as ways to help to pay for any ongoing medical bills.

Each person should think about the kind of financial issues that impact them personally. This includes mortgage interest rates, money market interest rates, their personal debt load, and their ability to access their funds as soon as they need them.

It also includes things such as the location of the branches near their home or place of business and the amount of money they need to keep in the bank account in order to avoid having to pay fees.

Each person should site down and think about what they're looking for in a new bank before they start.

Different Banking Services

A bank offers many different kinds of services.

Banks offer mortgage loans, personal loans, and loans to start a business.

A bank also offers help with opening money market funds and other kinds of savings vehicles.

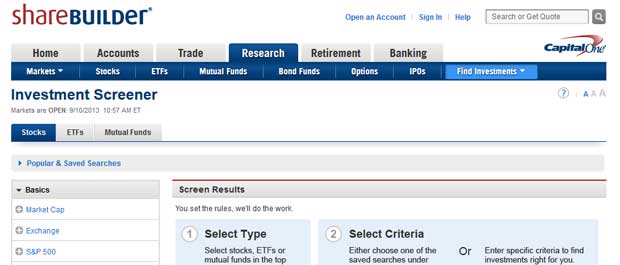

Banks provide people with the means to learn about the market and discover how it can work for them.

Many customers are looking for banks that offer friendly services from highly-trained staffers. They are seeking out advice about this crucial area of their lives. Staffers can show people how to open up an account. They can also help them order checks, make sure any savings are transferred between accounts, and demonstrate the right mortgage for their personal financial background. A bank can also show people how to open up an account they can access online and how to make sure their paycheck is directly deposited and all bills are paid electronically from the account and on time.

All of these services help the client create a firm financial base from which to use their funds most efficiently as well as make important plans for their personal financial future.

Superior Customer Assistance

Switching banks is a highly personal decision. Doing so, however, can bring rewards.

Banks love to bring in new customers, and many offer incentives of all kinds to bring people in. Things such as lowered or no fee checking, or even useful gift cards.

Bringing one's business to a new bank offers the opportunity to establish new connections that are useful for the client and allow them to find a bank that works better for their current needs.

A person's life circumstances can change rapidly over time. They may have a new baby or a new job in a new city.

They might have moved to another neighborhood.

It's a good idea to periodically consider the person's banking choices in the process. Help from a bank with staffers who are dedicated to providing superior customer service to all customers allows the client to determine the very best course of action for their deeply personal fiscal life situation.