There is no way to be completely prepared for a disaster. However, you can do your best to prepare yourself financially for an emergency that could cause you problems. If you haven't thought about it in the past, think about it now. Recent events, from large scale natural disasters (such as the earthquake in Japan) to man made problems (like last year's oil spill in the Gulf of Mexico) can impact your income, as well as prevent you from accessing your money. You need to be ready for these situations.

Build Up an Emergency Fund

An emergency fund is there for…emergencies. You should build one up so that you are prepared. Your emergency fund can help you pay for repairs not covered by insurance, and it can also help you offset other costs that might be related to a natural disaster. Another reason an emergency fund is important is that your income might be interrupted by a disaster. What happens if you can't get to work? Or if the disaster results in you being laid off altogether? If some sort of catastrophe knocked out the Internet in my locale, I'd experience a severe drop in income. An emergency fund can help you avoid complete financial disaster in such circumstances. Take some time to get your finances in order, and start an emergency fund.

Keep Emergency Cash at Home

As nice as an emergency fund is, you should realize that power outages and interruptions in the banking system can limit access to your money. An earthquake once made it impossible for me to get my money via ATM for two days. Realize, too, that a lack of power or downed phone lines can mean that using a credit card might be out. Have a stash of cash at home, kept in a safe place. Don't use it for every day expenses; instead, save it for when you really need it. Consider three days' worth of cash to complement your 72-hour kit.

Know Important Numbers, And Protect Your Financial Documents

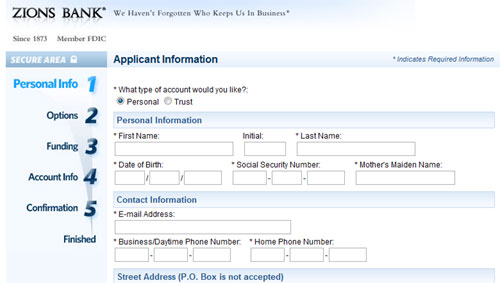

In addition to making sure that you have access to liquid funds, you need to consider your financial documents, and your financial accounts. Keep a list of financial account numbers and contact information for insurance policies, retirement plans, bank accounts, loans and credit cards. This list should be kept someplace safe and secure, along with hard copies of documents, such as insurance policies, loan papers, car and home titles, passports and birth/marriage certificates. A waterproof fire safe is one of the best options for these papers. You can even keep some of your emergency cash stash in the safe. That way, your most important information is safe guarded.

What If You Have to Leave?

Your next concern should be whether or not you have to leave. Your emergency stash of cash should be easy to get to, so that you can take it with you. Account numbers and other information should also be taken with you, just in case you need to get in touch with representatives of different companies. Have a 72-hour kit prepared for each member of your family (or create a family kit), and keep it somewhere accessible. These are things you need to grab and take with you in addition to cash and financial account information. You also need identification (if you have a passport, bring it along) and insurance cards.

Make sure everything you need is in a central location so that you can just grab it and go.

Do you have any other tips for financially preparing for a disaster?