A few weeks back I wrote about how the 2001 and 2003 Bush tax cuts will be expiring at the end of the year. At the time it really seemed quite possible that the tax cuts would be allowed to expire, and we would ALL be paying higher taxes come January 1st, 2011. Contrary to popular belief the tax cuts weren't just for the most wealthy, but in fact were put in place for everyone who pays taxes.

President Obama has made it known that he would like to renew the tax cuts for everyone, except those who make over $250,000. Personally I'd like to see the tax cuts renewed for everyone, and government spending slashed across the board.

So the question remains, will congress take up the issue of the Bush tax cuts before the November elections? Will they take it up at all, or just let them expire?

Will Congress Renew The Bush Tax Cuts?

This week we finally got some word on whether Congress will debate the tax cuts. It sounds like they'll be looking into it after the August recess.

Senate Democrats will hold a September showdown over trillions of dollars in expiring tax cuts passed under President George W. Bush.

Senior Democrats had expected the controversial issue to be postponed until after the election, but Senate Majority Leader Harry Reid (D-Nev.) plans to bring it up when lawmakers return from a five-week August recess.

That would make tax cuts a front-and-center issue in the days leading up to the midterm election. The debate promises to be contentious, pitting Democrats against Republicans, liberals against centrists and the Senate against the House.

“I expect it to be on the floor in September,” said Reid spokesman Jim Manley.

Senate Finance Committee Chairman Max Baucus (D-Mont.) acknowledged the Senate Democratic Conference remains uncertain how it will proceed, say sources familiar with talks about a package to extend tax cuts.

“Some members only want to extend the tax cuts for the middle class; some members want to extend all the tax cuts,” said a Democratic aide in reference to differences of opinion within the conference.

“We’re surveying members to see what could be in a package that wins 60 votes and protects the middle class,” said the source.

Democratic and Republican staffs on the Finance Committee have begun talks on how to mark up a tax extensions package. But Finance panel staffers have yet to delve into serious discussions over the substance of the bill.

So Harry Reid has said that we can expect to have the tax cuts brought up after the 5 week August recess. There are still a lot of questions about what type of an extension would be approved – whether it is one where all the tax cuts are extended, or one where they are extended for everyone except for the “wealthy”.

Extension Of Tax Cuts For Everyone, Or Just Some?

Republicans are fighting to have all of the tax cuts extended, while Democrats seem split – with some wanting to extend all of them, others wanting to extend only some, with still others wanting to let them expire completely.

Speaker Nancy Pelosi (D-Calif.)said she expects the Senate to take the lead on extending expiring tax-relief provisions.

Midwestern centrists such as Sens. Kent Conrad (D-N.D.) and Evan Bayh (D-Ind.) have called for an extension of all of Bush’s tax cuts, including those benefiting individuals earning more than $200,000 and families earning over $250,000 annually.

Other Democrats say they would consider raising taxes on individuals and families earning below those thresholds, despite President Obama’s promise that middle-class families would not see their taxes increase.

…

Republicans on Wednesday launched a pre-emptive attack against a partial extension of tax relief.

“They proposed to raise taxes on the top two brackets,” Senate Republican Leader Mitch McConnell (Ky.) said of Democrats during an afternoon press conference.

McConnell said increasing the tax burden on those brackets would affect 50 percent of small-business income and employees who make up 25 percent of the workforce.

McConnell said raising taxes in the middle of a recession would have a “devastating impact.”

So at this point, it sounds like Congress is leaning towards an extension of tax cuts, at least to some degree. The only thing that remains to be seen is whether they'll extend them for everyone, or if the top income brackets will see their taxes go up in 2011.

Conclusion

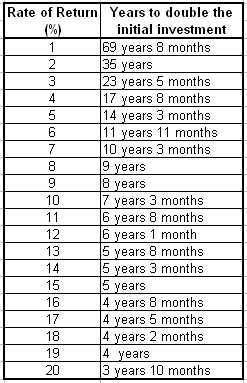

At this point a lot of people are waiting in limbo to see if their taxes will go up in 2011. (see how much they could go up here). For a lot of small business owners and other high income earners the different between having the tax cuts and not having them could mean a substantial amount of money lost or gained, so for them the stakes are especially high.

What effect will extending the tax cuts have? Some have said that raising taxes now in the middle of a downturn could be disastrous, while others claim that without the added tax revenues the economy will be sunk. I tend to lean more towards the side of tax increases right now being a bad idea – after all, the high income earners, small business owners and others are the ones who are creating jobs for others – and taxing them at ever higher rates will backfire at some point.

What do you think about the Bush tax cuts? Should they be extended, and extended for everyone? Do you think Congress will actually take action, or do you think they'll allow them to expire? Tell us your thoughts in the comments.